Nationwide, debtors with consumer and business debts filed 860,182 bankruptcy petitions in 2015, 11 percent fewer than in 2014. This was the lowest total since 2007, which was the first full fiscal year after the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 took effect.

Consumer (i.e., largely nonbusiness) petitions, which accounted for approximately 97 percent of all petitions, dropped 11 percent to 835,197. Business petitions, which amounted to 3 percent of all petitions, fell 12 percent to 24,985.

| Year | Filed Total | Filed Nonbusiness | Filed Business | Terminated | Pending |

|---|---|---|---|---|---|

| 2011 | 1,467,221 | 1,417,326 | 49,895 | 1,461,896 | 1,667,247 |

| 2012 | 1,261,140 | 1,219,132 | 42,008 | 1,304,432 | 1,624,606 |

| 2013 | 1,107,699 | 1,072,807 | 34,892 | 1,197,918 | 1,535,261 |

| 2014 | 963,739 | 935,420 | 28,319 | 1,099,666 | 1,401,5931 |

| 2015 | 860,182 | 835,197 | 24,985 | 989,872 | 1,271,865 |

|

Percent Change 2014 - 2015 |

-10.7 | -10.7 | -11.8 | -10.0 | -9.3 |

| 1 Revised. | |||||

Bankruptcy petitions may be filed under one of six chapters of the Bankruptcy Code. Most consumer petitions were filed under chapter 7 or under chapter 13. Most business petitions were filed under chapter 7 or under chapter 11.

| Chapter | Description |

|---|---|

| Chapter 7 | Provides that non-exempt assets are liquidated and proceeds distributed to creditors. |

| Chapter 9 | Covers local governments and instrumentalities. |

| Chapter 11 | Allows businesses to reorganize and continue operating. Also available to individuals whose debts exceed statutory limits for filing under chapter 13. |

| Chapter 12 | Covers family farmers and fishermen. |

| Chapter 13 | Provides that debtors with regular income retain assets and obtain court-confirmed plans to pay off their creditors. |

| Chapter 15 | Applies to foreign corporations and individuals. |

Filings under chapter 7 fell 14 percent to 550,036 and constituted 64 percent of all filings, down from 67 percent in 2014 and 71 percent in 2011. Nonbusiness chapter 7 filings, which accounted for 97 percent of all chapter 7 filings, also fell 14 percent and amounted to 64 percent of all nonbusiness filings, down from 67 percent in 2014. Business chapter 7 petitions fell 13 percent and constituted 66 percent of all business filings, down from 67 percent in 2014.

Filings under chapter 13 decreased 3 percent to 302,642. These petitions equaled 35 percent of all filings, up from 33 percent in 2014 and 29 percent in 2011. The 300,528 nonbusiness chapter 13 petitions, a decline of 3 percent from 2014, accounted for 36 percent of all nonbusiness petitions, up from 33 percent in 2014. The 2,114 business chapter 13 petitions, a drop of 10 percent from 2014, represented 8 percent of all business filings, the same as 2014.

Chapter 11 filings declined 8 percent to 7,040. Chapter 11 cases, which typically require significantly more court resources than chapter 7 or 13 cases, accounted for less than 1 percent of all filings. The 5,945 business chapter 11 petitions amounted to 24 percent of all business filings, up 1 percent from 2014.

The three remaining chapters of the Bankruptcy Code—chapter 9, chapter 12, and chapter 15–collectively accounted for less than 1 percent of all petitions filed.

| Year | Total | Chapter 7 | Chapter 11 | Chapter 12 | Chapter 13 | Other1 |

|---|---|---|---|---|---|---|

| 2011 | 1,467,221 | 1,036,950 | 11,979 | 676 | 417,503 | 113 |

| 2012 | 1,261,140 | 874,337 | 10,597 | 541 | 375,521 | 144 |

| 2013 | 1,107,699 | 753,995 | 9,564 | 405 | 343,651 | 84 |

| 2014 | 963,739 | 642,366 | 7,658 | 372 | 313,262 | 81 |

| 2015 | 860,182 | 550,036 | 7,040 | 383 | 302,642 | 81 |

|

Percent Change 2014 - 2015 |

-10.7 | -14.4 | -8.1 | 3.0 | -3.4 | 0.0 |

| 1 "Other" includes cases filed under chapters 9 and 15 of the bankruptcy code. | ||||||

Although bankruptcy filings decreased nationwide, with all 12 circuits reporting fewer filings, the rates of decline varied across regions. The districts located in the Ninth Circuit had a combined drop in filings of 18 percent. Reductions for the other circuits ranged from 7 percent to 12 percent.

The Federal Judiciary has 90 bankruptcy courts, one in each judicial district except for the Districts of Guam, the Northern Mariana Islands, and the U.S. Virgin Islands (where bankruptcy matters are addressed by the district courts), and the Eastern and Western Districts of Arkansas (which operate with one bankruptcy court). In 2015, 89 of the 90 bankruptcy courts reported fewer filings compared to the previous year. The Middle District of Alabama was the only court to register an increase in filings, a rise of 3 percent.

Terminations of bankruptcy cases fell 10 percent to 989,872. As terminations outpaced filings, pending cases dropped 9 percent to 1,271,865.

For data on activity in the U.S. bankruptcy courts, see the F series of tables.

Data are for the 12-month periods ending September 30, 2014 and 2015. Data for an individual district may be viewed by mousing over that district.

Adversary Proceedings

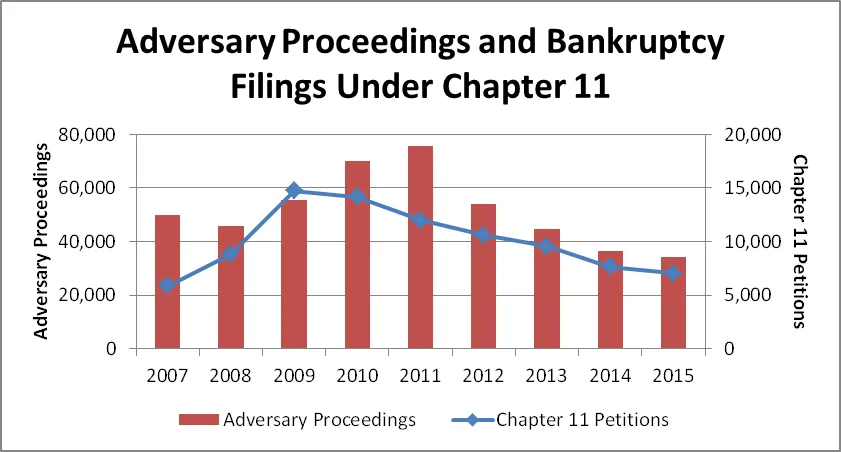

Adversary proceedings are separate civil lawsuits that arise in bankruptcy cases, including actions to object to or revoke discharges, to obtain injunctions or other equitable relief, and to determine the dischargeability of debt. Adversary proceedings may be associated with consumer bankruptcy cases, but most arise in cases filed under chapter 11. They generally reflect the level of chapter 11 bankruptcy petitions filed two years earlier.

In 2015, filings of adversary proceedings declined 7 percent to 34,113. This was 55 percent below the total for 2011. Sixty-one of the 90 bankruptcy courts reported lower filings, and 25 districts had reductions of 20 percent or more (compared to 39 districts in 2014). The largest numeric decrease was in the Southern District of New York, where filings dropped by 919 (down 55 percent) following a surge in filings in 2014 that arose mainly from cases involving the Eastman Kodak Company.

Filings of adversary proceedings rose in 29 bankruptcy courts, with 14 districts registering gains of 20 percent or more (compared to only 6 districts in 2014). The District of Delaware reported the largest numeric growth, an increase of 701 filings (up 70 percent), with most arising from cases involving chapter 11 bankruptcy filings in 2013 by two separate companies, Exide Technologies and Furniture Brands International, Inc.

Terminations of adversary proceedings declined 15 percent to 37,122. Pending adversary proceedings dropped 6 percent to 47,135.

Data on adversary proceedings in the bankruptcy courts can be found in Table F-8.

Judicial Business 2015

- Judicial Business 2015

- Judicial Caseload Indicators

- Judicial Business 2015 Tables

- U.S. Courts of Appeals

- U.S. District Courts

- U.S. Magistrate Judges

- Judicial Panel on Multidistrict Litigation

- U.S. Bankruptcy Courts

- Criminal Justice Act

- Post-Conviction Supervision

- Pretrial Services

- Complaints Against Judges

- Status of Article III Judgeships

- Status of Bankruptcy Judgeships

- Status of Magistrate Judge Positions and Appointments

- U.S. Court of International Trade

- U.S. Court of Federal Claims